Indonesia’s industry continues to expand, on track to becoming a global player

13 Oct 2022

Following the decline in COVID-19 infection rates, the overall business sentiment in Indonesia's manufacturing sector continues to be positive. September manufacturing PMI has shown a favorable performance, as the latest S&P global survey has shown.

Indonesia's manufacturing sector expansion rate in September was the fastest in the last eight months. The results of the S&P Global survey showed that Indonesia's manufacturing Purchasing Managers Index (PMI) in September was 53.7, up from August’s 51.7. This figure surpasses the average manufacturing PMI of the World (50.3), ASEAN (53.5), Eurozone (48.4), and China (48.1).

It was only slightly over two years ago, in April 2020, when Indonesia's PMI dropped drastically to 27.50 points following the economic shock from the outbreak. The country's PMI has continued to bounce back however and has remained above the 50-point mark since November 2020, excluding the July and August of 2021 period when the Delta variant of the coronavirus broke out. September’s PMI also marked another positive development following a 10-year industry expansion high in October 2021 (57.20).

Manufacturing Industries in Focus

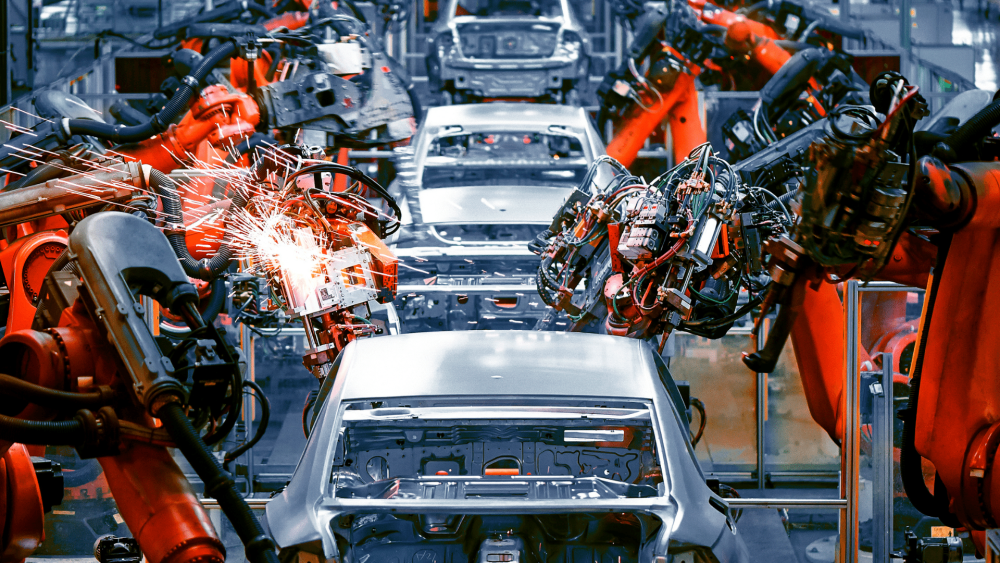

Since 2010, the manufacturing sector has provided the largest contribution from within the industries component of Indonesia's GDP. Indeed, the manufacturing sector has been at the core of the government's strategy in placing the country as the world's top ten largest economies by 2030. In line with these developments, the government has set five main industries to be the focus of the industrial revolution 4.0, namely food and beverage, textiles and apparel, chemical, electronics, and automotive.

The automotive industry deserves special attention as it is experiencing a significant shift towards vehicle electrification. As of August 2022, there are at least 4 electric bus manufacturers, 3 electric car manufacturers, and 31 electric motorcycle manufacturers with production facilities in Indonesia, with a total investment of Rp 1.872 trillion. Meanwhile, the Ministry of Industry has reported that the production capacity of electric vehicles per year in Indonesia currently reaches 2,480 units of buses, 14,000 units of electric cars, and 1.04 million units of electric two-wheeled and three-wheeled vehicles.

At the Focus Group Discussion B20 Side Event – Ready to eMove, held in Jakarta on Tuesday, October 4, Minister of Industry Agus Gumiwang Kartasasmita expressed optimism towards the national goal of having 2.1 million electric motorcycles on the road by 2025. Indonesian roads are indeed dominated by two-wheelers. Concentrating on this segment could indeed help achieve the country’s net zero emissions target by 2060.

In anticipating the number of electric vehicles to produce, manufacturers are well aware of at least two major challenges. The first is the shortage of chips and the availability of other key component such as batteries, power trains, and engines that still have to be imported. Another challenge is the price compared to traditional internal combustion engine vehicles – a major deterrent for the average Indonesian consumer.

The World’s Future Manufacturing Hub

Based on its stable economic growth and investment trends, Indonesia is expected to become a manufacturing hub in ASEAN – producing everything from electric vehicles to petrochemical products. Furthermore, the country is also predicted to be in the top seven of the world economy by 2045, as studies from PwC and McKinsey foresaw.

In meeting that potential development, as many as 135 industrial estate companies with a total land area of 65,532 hectares have established themselves across Java, Kalimantan, Maluku, Papua, Nusa Tenggara, Sulawesi, and Sumatra, as of January 2022. Accordingly, employment within the manufacturing sector have risen to 18.67 million workers in February 2022 from 17.82 million in the same month of the previous year. This runs parallel with the increase in investments towards the Indonesian manufacturing sector – from IDR 167.1 trillion in the first semester of 2021 to IDR 230.8 trillion in the first semester of 2022.

As a newly industrialized country, it may be surmised that Indonesia’s shift from a commodity-based economy to a manufacturing-based one, especially in the non-oil and gas segments, continues to move apace. Its strong domestic market – driven by programs such as Increase the Use of Domestic Products (P3DN) – should further leverage this industrialization process.