Indonesia’s Retail Remains Firm as Consumers Tighten Choice

08 Oct 2025

Retail in Indonesia remains firm. Household consumption continues to anchor the economy, inflation remains subdued, and retail sales show consistent year-on-year growth. With GDP expected to expand by more than 5% this year, the sector stands on solid ground. The mood has shifted, though: consumers are narrowing baskets and prioritizing essentials, leaving big-ticket purchases—cars and electronics in particular—under pressure.

Economic Foundation and Consumer Confidence

Indonesia’s economy grew 5.03% in 2024, and growth is projected to reach 5.2% in 2025, outpacing inflation, which is expected to stabilize at 2.6%. Household consumption remains the engine of growth, contributing more than half of GDP (53%).

Indonesia’s GDP Growth vs Inflation (2016-2024)

|

Year |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

|

GDP Growth |

5.03 |

5.07 |

5.17 |

5.02 |

-2.07 |

3.7 |

5.31 |

5.05 |

5.03 |

|

Inflation |

3.53 |

3.81 |

3.2 |

3.03 |

1.92 |

1.56 |

4.21 |

3.67 |

2.3 |

Source: BPS

Consumer sentiment supports this resilience. Indonesians are among the most confident globally, with 38.4% reporting they felt financially better off in 2024 compared to the year before, according to a Nielsen Survey. However, the Consumer Confidence Index (CCI) eased to 117.2 in August 2025––its lowest since 2022––showing that while optimism persists, households are increasingly cautious amid concerns over food prices and global economic uncertainty.

Consumer Confidence Index, Global

|

Country |

Score |

|

Indonesia |

38.4 |

|

India |

33.7 |

|

Saudi Arabia |

27.7 |

|

Egypt |

18.5 |

|

Mexico |

13.5 |

|

China |

10.7 |

|

South Africa |

9.2 |

|

Brazil |

8.7 |

|

Colombia |

7.8 |

|

Thailand |

-5.7 |

|

Singapore |

-7.5 |

|

South Korea |

-13.3 |

|

Chile |

-16.3 |

|

Italy |

-18.4 |

|

Poland |

-19 |

|

Australia |

-19.2 |

|

Spain |

-21.3 |

|

Germany |

-21.4 |

|

United States |

-22 |

|

United Kingdom |

-22.7 |

|

Canada |

-26.5 |

|

Turkey |

-29.4 |

|

France |

-30.9 |

|

Total Global (Benchmark) |

-2.06 |

Source: Nielsen

Indonesian Consumer Confidence Index (Jan – Aug 2025)

|

Month |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

|

CCI |

127.2 |

126.4 |

121.1 |

121.7 |

117.5 |

117.8 |

118.1 |

117.2 |

Source: Bank Indonesia

Further data from Bank Indonesia reflects this pattern. The Central Bank's Retail Sales Index posted 4.7% year-on-year growth in July 2025, the fastest since March, led by food, beverages, and motor fuel. Seasonal cycles continue to drive volatility, however, as evidenced by the 0.3 contraction in April sales following post-Eid normalization.

Indonesia Retail Sales Index Growth, YoY (Aug 2024 – Jul 2025)

|

Month |

Retail Sales YoY Growth (%) |

|

Aug 2024 |

5.8 |

|

Sep 2024 |

4.8 |

|

Oct 2024 |

1.5 |

|

Nov 2024 |

0.9 |

|

Dec 2024 |

1.8 |

|

Jan 2025 |

0.5 |

|

Feb 2025 |

2.0 |

|

Mar 2025 |

5.5 |

|

Apr 2025 |

-0.3 |

|

May 2025 |

1.9 |

|

Jun 2025 |

1.3 |

|

Jul 2025 |

4.7 |

Source: Bank Indonesia

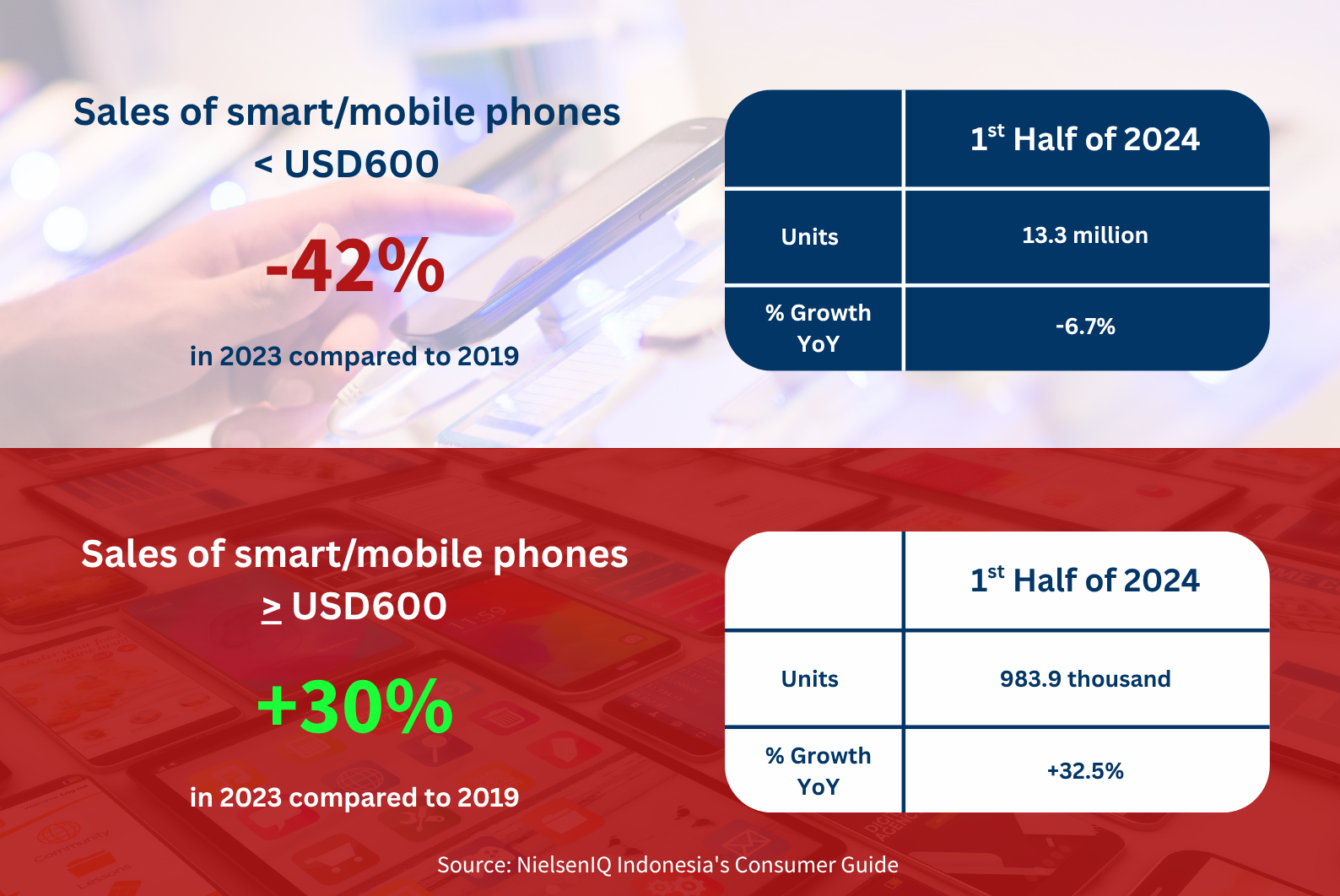

Despite the overall resilience, pressure points are emerging. Car sales have fallen sharply, down nearly 10% in the first half of 2025, and slumping 19% in August alone. Household appliances and electronics have also weakened, with Bank Indonesia data showing double-digit contractions in early 2025. These categories, which depend heavily on financing and consumer confidence, are proving more vulnerable to economic caution than everyday essentials.

Quarterly Car Sales Indonesia 2023-2025

|

Year |

Q1 |

Q2 |

Q3 |

Q4 |

Total |

|

2025 |

205,160 |

169,580 |

– |

– |

374,740 |

|

2024 |

215,069 |

192,943 |

225,206 |

232,505 |

865,723 |

|

2023 |

282,125 |

223,860 |

249,188 |

250,629 |

1,005,802 |

Source: Gaikindo

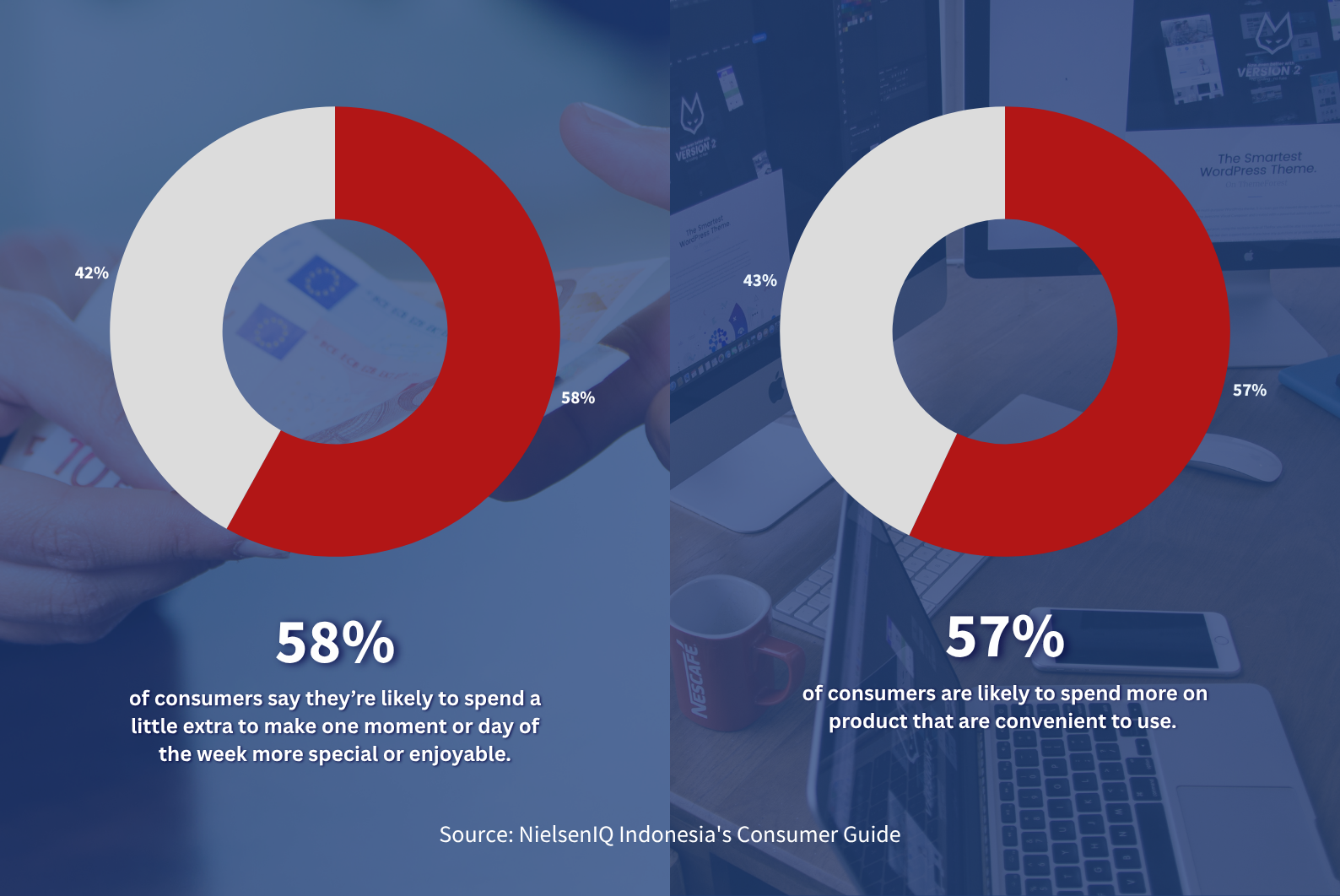

Retailers are also seeing shifts in purchasing behavior. Nielsen data reveal that 39% of cooking oil purchases in 2024 were promotion-driven, up from 22% in 2022. At the same time, 57% of consumers say they are willing to pay more for convenience, and 71% for products that last longer.

Sales of Smart/Mobile Phones in Indonesia (2019 vs 2023)

Indonesian Consumer Behaviour Statistics

Opportunities & Outlook

The medium-term picture remains positive. Research firms estimate the Indonesian retail market to grow by over USD 50 billion between 2024 and 2029, at a CAGR of 5%. Investments in logistics, payment systems, and omnichannel retailing are accelerating, while the government’s “1 Million MSMEs Digitalization” initiative is bringing small businesses into the formal digital economy.

Challenges, however, persist. Infrastructure bottlenecks and supply chain inefficiencies continue to limit expansion. Consumer sentiment, while generally strong, is not immune to global uncertainty and rising living costs. Sustainability is another pressure point: surveys show that 68% of Indonesian consumers prefer eco-friendly products, pushing retailers to adjust sourcing and operations.

Indonesia’s retail sector in 2025 is defined by resilience with more selective spending. Essentials, groceries, and convenience retail are steady, while premium and lifestyle categories still attract aspirational purchases. Durable and discretionary goods—cars, appliances, and electronics—are under gentler demand and tend to move with the cycle.

In the longer run, the sector’s trajectory will hinge on maintaining balance: clear value for cautious households alongside quality and innovation for those still willing to trade up. With a population of over 270 million and a rapidly digitalizing economy, Indonesia’s retail sector remains one of the most promising in Asia—so long as the wider environment keeps purchasing power intact and goods moving.